Pawning Vs Selling: Which Is Better?

Pawning vs Selling: Which is better?

Should you sell your items as you normally do and lose ownership or use your items as collateral to get a loan as 30 million Americans do every year, and still be able to get your items back upon repaying your loan?

Perhaps the confusing part is that both methods can help you solve your current financial need.

But how can you tell whether you should pawn or sell your belongings?

To help you out of the confusion, we have researched both methods and compiled this article so you can make an informed decision.

Below, we will explain the two processes and talk about the pros and cons of each method to help you decide which method is best suited for your financial situation.

Let’s get started.

Is it better to pawn or sell?

To know which is better between pawning and selling depends on your individual preferences. When you pawn an item, it serves as collateral for the loan secured. Once you pay back the loan within the agreed time, you get back your item.

When you sell an item, you give it away in return for money.

While both processes serve the same purpose – to help you solve your financial problem – your specific situation will determine which method is better for you.

Pawning vs Selling – What’s the difference?

Typically, when you sell your items, it’s final. You lose ownership of the items.

While many people prefer this method, it tends to be emotionally difficult especially if you want to solve a temporary financial need.

Undeniably, the process is fast as long as your items are valuable and you’re selling to a knowledgeable person.

On the other hand, pawning your items is using your items as collateral to get a loan. When repaying the loan to secure your items, you’re required to pay the amount with a certain interest rate regulated by state laws.

If you’re looking to solve a short-term financial problem, then pawning is the right option for you. Just make sure you are pawning at a reputable pawn shop that can evaluate your items and give a reasonable loan that you will be able to repay when you want to repossess your items.

That said, let’s explore both methods further.

What is Pawning?

As mentioned above, pawning is simply surrendering your item in exchange for a short-term loan that you will repay under state-regulated interest fees.

Note that pawn shops don’t accept just any kind of item.

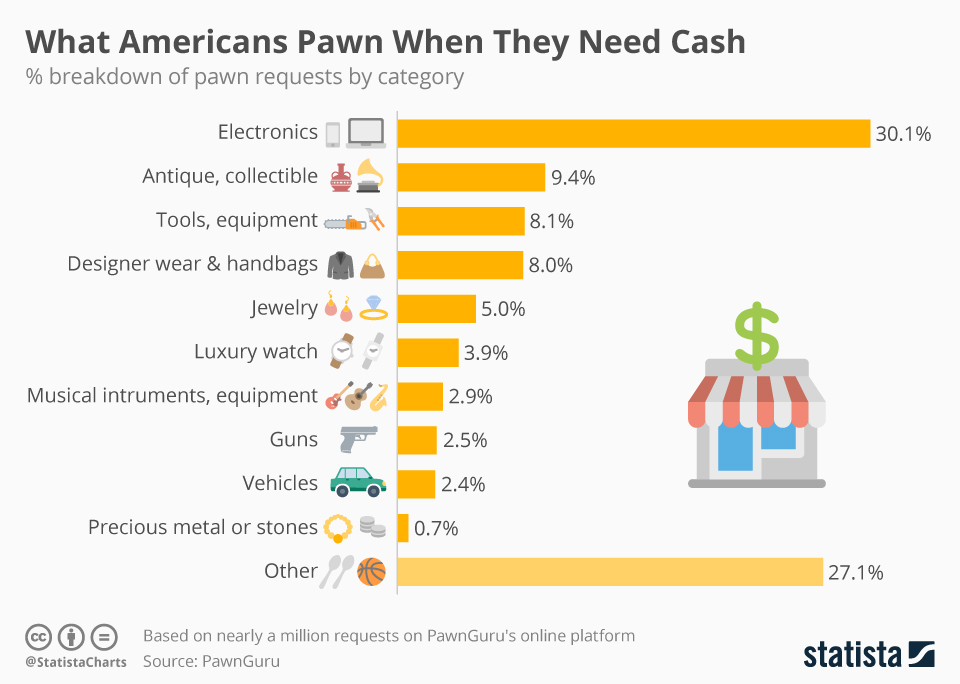

Generally, you can pawn items like jewelry, diamonds, electronics such as laptops, lawn mower machines and luxury watches. According to Statista, Americans pawn even guns and vehicles. Below is a chart from Statista of what Americans Pawn:

The pawning industry is currently a $14 billion market. The U.S alone has over 11,000+ pawn shops.

Typically, pawning is a good option for you if you need an instant loan, and given the availability of online pawning, it’s even quick and easy to pawn items these days.

However, you cannot get a lot of cash pawning items.

When pawning, you bring your items to a pawn shop then the pawnbroker assesses the value of your items and agrees to lend you a certain amount of money.

The pawnbroker uses the items as collateral for the loan given to you – the pawn shop takes temporary possession of the items for a set amount of time.

If you fail to pay on time, the pawnbroker takes complete possession of your items and can sell them.

Of course, when you repay the loan plus the interest fees before the agreed upon time elapses, you can always get back your items. But once the pawnbroker sells them due to late repayment, you lose ownership of them. And there is nothing you can do afterward.

Pawning: The Good Side

Part of the reasons why many Americans pawn their items is that once you repay the loan on time, you can always get them back. Remember that pawning doesn’t guarantee a lot of cash. That means that you can pawn valuable gems like diamonds at half their original price. But the good thing is that, once you pay the loan, the pawnbroker surrenders your pawned item.

Pawning doesn’t hurt your credit score. One thing you don’t want to mess up with is your credit score. The good thing about pawning items is that the pawnbroker evaluates the value of your items when giving you a loan but not your credit score. So, pawning can help you secure a loan (even though it’s little money) even if you have a bad credit score.

Besides, even if you default the loan, your credit score doesn’t get affected.

Another good thing about pawning is that it’s a quick and easy process.

The waiting time involved when taking a loan from the bank makes pawning a suitable option if you need instant cash.

Even worse, you may fail to secure the loan from the bank, but with pawning, as long as your items are valuable, you’re guaranteed to get the loan.

Pawning: The Bad Side

Failure to repay the loan on time may result in penalties or even loss of ownership of your items.

Typically, with pawning, you’re given a strict duration for repaying the loan, within which, you’re required to pay the loan fully.

You may choose to renew the loan but in the end, you will pay more money to get your items back.

Also, pawning doesn’t guarantee a lot of cash. Yes, you pawn your valuable jewelry, and you’re given a small percentage (almost a quarter of the price of your jewelry).

Think about if you default the loan, you lose your valuable jewelry. Worse, there is nothing you can do about it because that’s how pawn shops operate.

What Is Selling

As stated above, pawn shops are for instant loans that you get in exchange for your items.

Nevertheless, you can still sell items to a pawnbroker.

Selling your items to a pawn shop is just bringing your items to the pawnshop, the pawnbroker assesses them and determines the price then you’re given cash immediately.

In simple terms, selling is the exchange of items for money.

But why not pawn your items and get them back when you pay the loan secured? Why is selling better than pawning?

Let’s explore the good sides of selling:

Selling: The Good Side

Unlike pawning, selling items guarantees a lot of cash.

Think about it. If you were to pawn a watch valued at $500, you’d get a loan of around $150 or even below. Selling the watch would see you getting around $250.

Ideally, if you’re looking for a good amount of money but you don’t want to struggle to pay loans, then selling would make the best option for you.

Selling allows you to dispose of the things you don’t need. If you no longer need a watch, you can sell it and make money.

Interested in selling your items? Here’s an article highlighting where you can sell your items online for free.

Selling: The Bad Side

When you sell an item(s) you lose the ownership completely. But you can still get back your pawned items once you repay the loan.

On the other hand, you can pawn your items, pay back the loan, and pawn them again.

Recommendation

If you’d like to sell your items online, consider listing them on our very own Sheepbuy. There’s no selling commission ever and our basic tier lets you post up to three items, free of charge.

You can sell anything on Sheepbuy in any form of condition, permitted by paypal of course.

The best part is when your item sell there are never any selling or hidden fees.

All transactions are strictly between buyers and sellers. All purchases are safe and secure via paypal. For more information on buyer protection by paypal click here.

Sheepbuy only caters to verified sellers as an added protection to buyers. Meaning their phone, email and bank account must be verified inorder to link their account onto Sheepbuy.

For more information of how to use sheepbuy click here.

The Bottom Line

So, now you know the difference between pawning and selling. You’re now aware that when you pawn items, you can still get them back as long as you repay the loaned amount of money within the agreed time but when you sell them, you lose complete ownership of your items.

You also know that with pawning, you don’t get a lot of cash, but you can still get another loan with the same items upon repaying the loan. And you understand that selling items helps to dispose of items you no longer need.

You also know that selling items guarantees a lot of cash but it can be emotionally difficult in case you need your items back.

We hope this article helps you to decide which is better between pawning and selling.

Recommended Blog Posts:

TRENDING

Online Arbitrage for Beginners (Step-by-Step Guide)

17 Types of Arbitrage Strategies to Turn a Profit

Is Retail Arbitrage Legal?

How to Turn Textbook Arbitrage into a Business for Profit

How Can You Tell if a Book is a First Edition?

What to Do With Your Jigsaw Puzzle When Finished?